According to the Oliver Wyman MRO Forecast 2019 engine MRO will have some ups and downs over the next decade. “In the first five years, new engines are expected to lengthen the interval between shop visits with less need to replace life-limited parts and to conduct other scheduled maintenance,” that forecast predicts. They say that the new gen engines are more fuel-efficient but use more expensive materials and complex technologies that “can be quite expensive to replace or repair when the time comes.” Still, most engine shops are full right now and seeing unprecedentedly good times.

The commercial engine MRO market is thriving despite widespread geopolitical and economic uncertainties. Continued high demand for air travel, low fuel costs, new-engine issues, and new-aircraft delivery problems, are among the factors keeping older models of aircraft and engines flying.

Engine makers are focused on smoothing the rollout of new models, providing opportunities for traditional players. Since most of the MROs are also allied with the OEMs, they can win business when OEM capacity comes under strain. But a big challenge is finding slots for shop visits and locating parts to build up engines. Capacity is expanding at a rapid clip.

“We are getting to the point where engine shops are all at capacity. There are very few out there that are not full,” notes Paul Richardson, AAR’s vice president of sales for the parts supply business, Europe, the Middle East, and Africa. AAR manages the engine overhaul process with MRO partners and provides non-core component service, as well as parts support.

Large MROs are involved not only in touch labor but also in areas such as component repair; engine trading, leasing, and exchange; used serviceable material (USM); and teardowns/part-outs. So dips in one area are balanced by boosts in others.

Fuel prices today are 40 percent lower, compared to the average price from 2010-2014, notes Bill Dwyer, services marketing leader, GE Aviation. “In that sense, it’s a tailwind to mid-life aircraft, especially since interest rates have risen 2 percent in the last 24 months.” Higher interest rates and relatively low fuel cost mean that the capital cost of new aircraft outweighs the fuel efficiency benefit financially, he explains. The fastest growing engines are those which entered service in the past five to eight years, such as the GEnx. GE Aviation boasts an engine services backlog of $206 billion.

“Supply chains have clearly been tight, with the simultaneous introduction of multiple new aircraft programs to address higher fuel costs from 2008-2014,” he says. “However, we believe the worst is behind us, and significant resources have been put into mitigating production capacity constraints.”

StandardAero anticipates that the commercial engine market will grow at a roughly five percent compound annual growth rate (CAGR) during the next few years. The company expects to enjoy robust growth in this market with the ramp-up of its newly industrialized RB211-535 program and its presence on steady growth platforms such as the CFM56-7B, CF34-8, PW127, and PW150, according to Alex Trapp, senior vice president of business development.

MRO demand today is a “perfect storm,” says Martin Friis-Petersen, senior vice president for MRO programs with MTU Aero Engines. MTU Maintenance has a portfolio of around 30 engine models across the entire lifecycle and a capacity of more than 1,100 shop visits within its network. Key volume engines such as the V2500 and the CFM56 are being served in three different locations, increasing flexibility.

In addition there have been “teething problems” in the market regarding new engine types, such as the LEAP and GTF, says Marc Wilken, senior director product sales, with Lufthansa Group Key Account Management & Engine Lease. These have led to an increasing demand for short-term solutions and earlier capability build-up, he adds.

LEAP and GTF teething problems mean that new product lines need to be up and running earlier than estimated, which calls for a fast and focused ramp-up of new facilities. LHT also has “introduced temporary product lines in Hamburg for both the GTF and the GEnx-2B in order to support our customers.”

The grounding of the 737 MAX also introduces an uncertainty factor into the short-to-medium-term evolution of the world medium-haul fleet, notes Michael Grootenboer, AFI KLM E&M’s senior vice president, engine product. It means that existing engine types like the CFM56-7B are staying on wing longer, pending the MAX return to flight, and that they may see more significant work scopes when they do come off, he adds.

Popular Types

At the moment the MRO market is dominated by CFM56 and V2500, Wilken says. These stalwarts will account for the majority of yearly engine overhauls until the end of the 2020s, he predicts.

But shop visits for the newer versions of V2500 and CFM56 engine families – the V2500-A5, CFM56-5B, and CFM56-7 – will peak by the mid-2020s, MTU’s Friis-Petersen says. Demand for services for older legacy engines, such as the CF6-80C2, has continued longer than expected – thanks to low fuel prices and high air transport demand, where demand for aircraft and engines exceeds delivery rates. Also, new-generation engines are entering the shops earlier than originally anticipated and will ramp up in the next decades. “All this has led to our shops being fully loaded worldwide.”

AFI KLM E&M is likewise seeing strong demand across all of its product lines, Grootenboer says. The CFM56, both -5B and -7B, have yet to reach their peak volumes. And demand on the GE90 is also strong.

Moreover, “in [recent] years we have witnessed a ramp-up of new engines at a speed that has never been seen before,” he says. AFI KLM E&M sees this as an opportunity, as it “has proven to be a frontrunner in industrializing maintenance on new platforms like GEnx, LEAP, and imminently on the Trent XWB.” We anticipate continued strong market growth with Asia seeing the largest increases, Grootenboer says.

In terms of sheer volume, the V2500 and CFM56 continue to see huge demand for MRO services, with reasonably steady growth, StandardAero’s Trapp agrees. But in pure percentage growth, it’s the GTF, soon to be followed by the LEAP. “The widebody market is smaller but heavily growing, with programs maturing like the Trent 700 and GE90, continued in-service activity with CF6 and PW4000, and the introduction of new engine programs like the Trent 1000, GEnx, and Trent XWB.”

With over 7,000 engines in service, the V2500 engine will be in high demand for the next decade or more, predicts Joe Sylvestro, vice president, global aftermarket operations for Pratt & Whitney. “We expect the PW4000 and PW2000 engines to still be in service and continue be an important part of our overall engine portfolio, just at lower rates than the prior decade.” In fact, PW2000-powered B757s are in very high demand in the used aircraft marketplace, he adds.

Parts Squeeze

It’s challenging to find new parts to support legacy engines, AAR’s Richardson says, as OEMs tend to focus on new engines. MROs are seeing longer lifecycles in the shops. What was once a 60-day window may become a more than 90-day window in large part because of the time required to collect the inventory to build the engine.

“The biggest growth constraint for engine MRO providers is the availability and timely supply of certain new parts from engine OEMs,” StandardAero’s Trapp asserts. “Currently, and for several months now, demand is outstripping supply in forging and casting suppliers, as new-generation engine program production and aftermarket requirements have collided with aftermarket demand from legacy engine programs.”

StandardAero has “partially repaired engines sitting in our shops waiting for specific parts, which is constraining physical capacity, extending turn times, and disallowing delivery of engines back to our customers,” Trapp says. Because legacy aircraft continue to fly — which is a positive trend — “there is a scarcity of used material, driven by less retirements and high consumption demand.” At StandardAero, “we are seeing extremely high demand for our services across all engine platforms, yet an inability to provide the capacity to service all of the demand due to lack of parts availability,” he says.

One of AAR’s growth strategies is building up its engine pools, Richardson says. These engines, which have been “basically put through the shop ahead of time,” will help customers who may not have been able to get a shop visit. It means finding an unserviceable engine in the market, overhauling it, so that it’s a “high-cycle, strong engine,” and making it available for sale, lease, or exchange. The trick is to find an engine that — with relatively little investment — can be made serviceable again, he says. “That’s the ideal candidate.” The company is looking at “increased flow” for RB211-535s and CFM56-7s, for example.

“We will be opportunistic, based on market movements, but also tailor solutions to support the customer,” for example, by building assets to a tailored work scope, he says.

As part of its “global yet local” strategy to be close to customers, MTU just opened an MTU Maintenance Lease Services office in Singapore. This makes sense as, by 2029, around 40 percent (vs. today’s 23 percent) of the world’s fleet will be operating in the Asia-Pacific region, a large proportion of them on lease, Friis-Petersen says. And more than 2,000 aircraft are expected to be retired in Asia in the next 10 years. So with the Singapore office, “we are ideally placed to support asset owners with their large maturing and migrating fleets.”

StandardAero notes that MAX issues have created an opportunity, as airline demand “has been backfilled by aircraft powered by engines on which we perform MRO services, such as CFM56.” On the other hand, parts supply challenges have led StandardAero to “constantly deploy creative solutions for creating induction slots,” Trapp says. For example, it partially builds engines “to be ready to receive the last remaining parts upon supply and [to be] released immediately thereafter.” StandardAero also uses its repair development capabilities to create new repairs, and uses its supply base “to procure used material or tear down engines for parts where appropriate.”

We know that, in general, customers are looking for quality and fast turnaround time, he says. “We also know that on mature platforms, the requirements can skew towards cost and customized solutions facilitated by … used serviceable material, component repair and repair development, asset acquisition disposition, engine exchange programs, [and] creative work-scoping.” This allows room for solutions such as module-level MRO and lifecycle-optimized build lives. As an independent MRO, he says, StandardAero has a long history of providing these solutions across market sectors, engine platforms, and products manufactured by all of the major OEMs.

AFI KLM E&M also “is constantly developing innovative repair solutions to lower the cost of ownership” and address tightness in the supply of replacement parts, Grootenboer says. Some examples are fan mid shaft repairs for the GE90 and GEnx at its facility in Amsterdam and GEnx combustor repairs in its subsidiary, CRMA.

AFI KLM E&M also is experienced in sourcing and using high-quality USM at competitive prices, via its large USM trading network. Moreover, Bonustech in Miami provides dedicated engine teardown capabilities within the AFI KLM E&M footprint, and the MRO adapts its use of USM to build customers’ engines to their preferences and specifications.

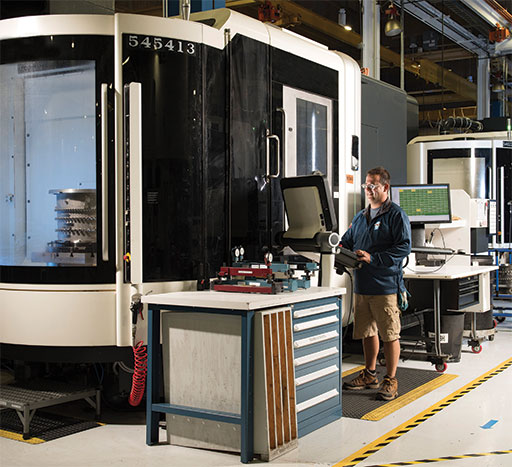

Growing Capacity

Pratt & Whitney has invested about $450 million since June 2016 at its Columbus, Ga., facility to upgrade equipment, expand production, increase capacity, expand GTF engine maintenance capability and capacity, and construct a new GTF engine overhaul facility, Sylvestro says. An estimated capital investment of nearly $85 million will outfit Eagle Services Asia with capabilities such as an environment control system and an engine flow line system.

P&W’s GTF network currently includes itself, MTU, JAEC, Lufthansa Technik, and Delta TechOps. The OEM likewise boasts 10 third-party repair suppliers — Turbine Controls, StandardAero, TWIN MRO, ACMT, Lewis & Saunders, FAG Aerospace (Schaeffler), American Cladding Technologies, Tube Processing, MDS Coating Technologies, and MB Aerospace, Sylvestro says. P&W also has invested in its West Palm Beach facility.

MTU is adding capacity at all its locations. On the mature engine side it is introducing the CF6-80C2 in MTU Maintenance Canada alongside the V2500. MTU Maintenance Zhuhai, which services current-generation engines such as the CFM56 and V2500, is slated to expand by 50 percent — to 450 shop visits p.a. — in 2021.

In Hannover, MTU is adding 22,000 square meters of hall space. On the new engine side MTU Maintenance is adding LEAP capabilities via MTU Maintenance Zhuhai, and is building its LHT JV, EME Aero, in Poland specifically for the geared turbofan family. It is expanding Airfoil Services Sdn. Bhd, the Malaysia-based JV with LHT and planning a new parts repair site in Serbia. MTU Maintenance Serbia, to start operations in 2022, will create 400,000 repair hours.

The Zhuhai shop also has inducted its first LEAP-1B quick turn engine. “We will build up to full overhauls of -1B engines over the course of the next year or so and, according to our licensing agreement, introduce -1A services at a later date,” Friis-Petersen says.

“The supply chain for engine MROs is struggling to keep up with the high demand for shop visits,” agrees Rune Veenstra, chief business officer for Aero Norway, which repairs and overhauls CFM56-3, CFM56-5B and CFM56-7B.

The forecast going forward shows that there will be more shop visits for the CFM56-5B and 7B for the next five years, he says. “This will create high pressure in the engine shops … .”

In October 2019 GE Aviation and Lufthansa Technik launched XEOS, a facility in Poland that will specialize in overhauling GEnx-2Bs and GE9Xs, Dwyer says. EME Aero, LHT’s GTF joint venture with MTU Aero Engines, is ramping up on schedule. LHT also is launching a wholly-owned subsidiary in Hungary for engine parts and accessories repair and overhaul, slated to begin operations in 2022. Meanwhile LHT’s shop in Hamburg can simultaneously handle CFMs, V2500s, and LEAPs.

StandardAero has expanded its large engine capacity through the acquisition of high thrust test cells, allowing the MRO to win and industrialize the RB211-535 program. And it has expanded component repair capacity in existing locations in Cincinnati and Miami.

New technology

Pratt & Whitney recently introduced its Track app, which provides access to order information with a few taps of a finger, Sylvestro says. Customers can track spare parts orders, component repair orders, and engine overhauls, using filter and search options that improve order visibility.

LHT, meanwhile, has set up a new data aggregation, processing, and sharing company, called AVIATION DataHub. The MRO currently holds a 100 percent stake but plans to add other shareholders and partners from the aviation industry.

LHT announced this summer that Croatia Airlines is using the predictive maintenance tool, AVIATAR. Swiss International Air Lines, another AVIATAR user, has reported steady improvements in its processes, the MRO says, thanks in part to the proactive replacement of components.