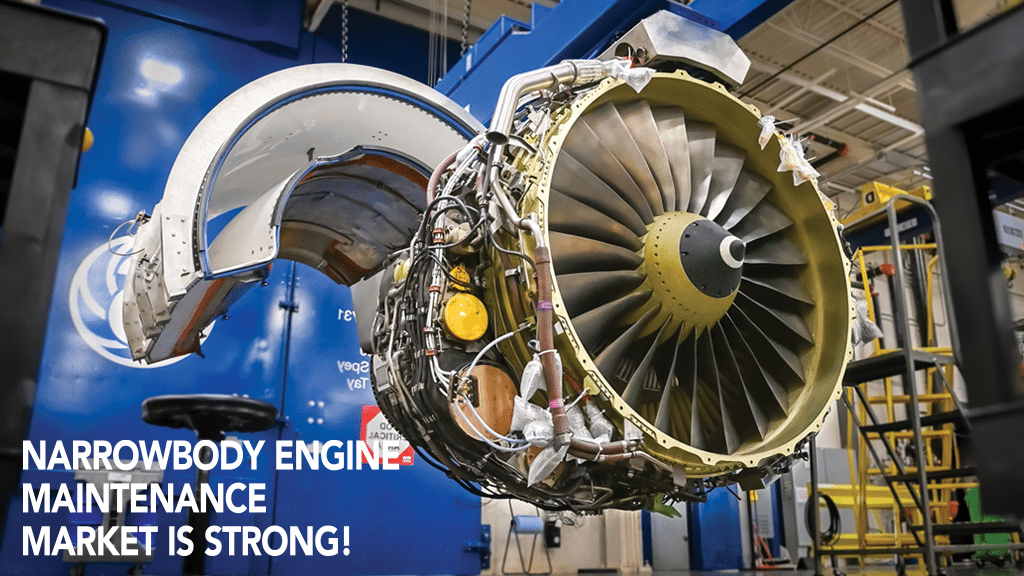

The airline industry’s enduring love for cost-effective narrowbody aircraft is driving strong growth in the narrowbody engine maintenance market. This growth is good news for MROs that service these engines — such as Aero Norway, MTU Maintenance, StandardAero, and ST Engineering — plus companies such as AJW Group that support these MROs with narrowbody engine parts.

VP Sales, StandardAero

Airline Traffic Driving Growth

The main reason the narrowbody engine market is very healthy is due to the strong recovery of the single-aisle segment, said Mark Thompson, vice president of sales, Americas & Asia-Pacific, with StandardAero’s airlines & fleets team in Scottsdale, Arizona.

“Per Aviation Week, narrowbody aircraft utilization during Q1 2024 was up 10% compared to the same period in 2019, while widebody utilization was still down 1%,” Thompson told Aviation Maintenance magazine. “As a result, MRO demand for CFM56-5B and -7B engines remains high, due the large, active installed base — 45% of which has yet to undergo their first shop visits — amplified by the popularity of mature types such as the A320ceo and Boeing 737 NG as ‘fill-ins’ for new generation airliner fleets impacted by the recent GTF powdered metal issue.”

“The demand for narrowbody engine maintenance is strong thanks to airlines resuming flying activities post-Covid and consequently requiring more shop visits for their fleets’ engines,” agreed Tay Eng , senior vice president/general manager, engine services, with ST Engineering in Singapore. “Moreover, during the pandemic, airlines had delayed MRO work by parking unserviceable engines aside and relying on their serviceable engine pools, resulting in pent-up demand for engine maintenance,” he said. “This is why, across the industry, we are seeing high demand for CFM56 heavy maintenance and quick-turn services for the LEAP engines even as MRO slot availability is limited.”

This same positive trend is being reported by MTU Maintenance Zhuhai in China. “Demand strongly recovered throughout 2023, with a strong ongoing demand for CFM56 shop visits, especially the -7B model,” said Christian Ludwig, the company’s chief operations officer. “Of course, we continue to see early technical removals and shop visits coming our way from newer engine models such as the PW1100G-JM and PW1500G, as well as the LEAP. In addition, we are seeing a continued but softening demand for hub project shop visits on the V2500.”

By proportion, the MTU Maintenance network performs the largest number of shop visits for the V2500, followed by GTF engines, the CFM56-7B and its -5B sibling, and LEAP engines. “It is interesting to note that demand for lower thrust engine variants has picked up recently,” Ludwig said. “Over the past few years, these engines have tended to only come into the shop after their host aircraft (usually an A319 or 737-600/700) had been retired and the engines needed conversion to a higher thrust variant for use on a larger aircraft variant. Recently, such engines are being overhauled and remain in service.”

Half a world away, the news is also good for Aero Norway AS. “The demand for narrowbody engine MRO remains strong, with CFM56 engines powering a range of aircraft including the Boeing 737 series and certain Airbus A320/A319 models,” said company CEO Neil Russell. “Additionally, CFM International LEAP engines are propelling newer versions of the Airbus A320neo and Boeing 737 MAX. As these modern aircraft are being delivered and integrated into service, the demand for maintenance services for LEAP engines is steadily rising.”

As AJW Group’s director of engines, whose company provides parts to MROs worldwide, Wasim Akhtar has a global view of the narrowbody engine maintenance market. Based on this perspective, “the demand for narrowbody engine maintenance is currently soaring primarily due to postponed shop visits and OEM delays,” he said. “The upturn in demand is further driven by the ongoing recovery of leisure and business travel.”

Based on AJW Group’s parts sales, “the highest demand is for the CFM56-5B, CFM56-7B tech insertion (TI) configuration and select 1 and 2 when it comes to V2500-A5,” said Akhtar. “Operators are prioritizing these newer engine configurations to align with environmental regulations and sustainability goals. Meanwhile, based on our current knowledge and understanding, the market can expect approximately 1,500-2,000 shop visits for the CFM56-5B and CFM56-7B engines, as half of this current twenty thousand strong fleet is yet to go through their first shop visits.”

Varied and Wide-Ranging

According to the experts interviewed for this article, the range of maintenance being performed on narrowbody engines is varied and wide-ranging. “It depends on a number of factors, including the age of the engines, their maintenance history, and their operating environments,” MTU’s Ludwig said. “While mature engine types see it all, newer engine types come as so-called quick turns, touching one or two modules only, or SBs on externals.”

Over at StandardAero, “we are seeing demand for the spectrum of MRO service offerings, from full performance restoration shop visits (PRSVs) to quick-turn (or hospital) shop visits, which offer a fraction of the time-on-wing of a PRSV, albeit at lower cost,” said Thompson. “This demand for hospital shop/quick-turn engine services was a key driver behind StandardAero’s decision to establish additional CFM56-7B MRO capabilities at our DFW International Airport location. We are also seeing demand for module swaps and green time engines, as supported by our PTS Aviation asset management subsidiary.”

This being said, ST Engineering’s Tay is seeing some patterns emerging. “For CFM56 engines, the most common forms of maintenance are core engine performance restoration and full performance restoration that typically involve replacing life-limited parts,” he noted. “Meanwhile, for LEAP engines, a common maintenance task would be to address LEAP-1A high-pressure turbine distress; preparations are also underway to manage similar challenges in LEAP-1B engines for high-pressure turbine and combustor distress. Additionally, we are gearing up to accommodate retrofitting needs for the reverse bleed system in both LEAP-1A and LEAP-1B engines.”

Aero Norway is seeing both patterns and variety. The reason? “As the CFM56 series of engines is modular, the total cycles fluctuate across all major modules and different operators and owners have different needs, so the workscopes can be very varied,” said Russell. “These can range from complete LLP (life limited parts) changes and performance restoration, to changing out a fan containment case.”

As for factoring in some degree of predictability into the narrowbody engine maintenance process? According to AJW’s Akhtar, this should be possible. “This is because the narrowbody engine types are primarily maintained on a conditioned basis, as per the OEM guidelines,” he explained. “At the same time, operators and lessors are investing in the maintenance of older aircraft to keep them in service due to the current supply chain issues with the new aircraft and engine types.”

This continued use of older narrowbody aircraft does result in a more diverse and mature range of engines in the market, said Akhtar, which brings extra challenges for MROs and airlines alike. “For example, booming demand for engine parts has driven up prices and OEMs have seized the opportunity to capitalize on this demand,” he said.

Supply Chains, Staffing Lead Times Top List of Challenges

Wasim Ahktar’s point about the booming demand for parts points to one of three top challenges facing MROs and suppliers alike in the narrowbody engine maintenance market. Even though covid-19’s shakeup of the world economy is chronologically years in the past, “Supply chain disruption is the primary challenge associated with the MRO of these engines,” said Russell. “Despite our efforts at Aero Norway to strategically plan ahead for materials and induction slots, the existing conditions at vendors and in the aftermarket can result in longer lead times.”

Director of engines, AJW Group

MTU is experiencing similar problems. “Supply chain pressures are still persistent and with fewer aircraft retirements than anticipated and fewer respective engine teardowns, the parts supply market remains tight,” Ludwig said. “So getting your hands on used serviceable parts — and new parts for any generation engine — in a timely manner is a big challenge, which then translates into longer turnaround times. We are seeing this across the industry.”

The good news? According to Ludwig, there have been some supply chain improvements associated with the CFM56 parts market in recent months. “But for new generation engines and the V2500, used serviceable material is still experiencing constraints.”

With demand outstripping supply, the impact on parts’ prices has been predictable. According to Akhtar, the catalog list prices of new parts have gone up by about 12%, which means the market value of used parts has also gone up. As well, “the market is still being influenced by the challenges in the OEM sector post- pandemic, more specifically the availability and delivery schedules of engines,” he said. “It is going to be well beyond 2026 before we see an alleviation in this situation. By then, the shop visits would have peaked and the engines we deal with will still be worthwhile repairing and using for component supply. Scheduled aircraft retirements will improve the parts supply over time, which will soften the current demand to some extent, but this won’t happen anytime soon.”

Staffing is the second top challenge confronting the narrowbody engine maintenance market. Simply put, “there is a general shortage of new young talent to fill the vacancies on the shop floors that are left behind by retiring technical staff within the industry,” said Ludwig. Add supply chain issues, and “there is a bottleneck situation at the repair shops due to labor issues further escalated by the shortage of raw materials,” Tay said. To exacerbate the human resources issue, “newer engines such as LEAP engines have more complex designs that include advanced technologies and composite materials. To maintain these engines, the workforce must possess the required expertise and capabilities.”

These first two problems combine to create the narrowbody engine maintenance industry’s third top challenge: Long lead-times, both for booking maintenance work at MROs and then actually getting the jobs done. In fact, the biggest change since Covid for MROs and airlines alike are “shop visit lead times, due both to the high demand for engine slots plus continuing shortages associated with certain engine parts,” said Thompson. “While StandardAero has always pursued a ‘repair rather than replace’ philosophy wherever practical, and while our component services team does have in-house parts manufacturing capabilities, we still rely on original equipment (OE) vendors for certain parts, and the supply chain remains in a fragile state in the aftermath of the pandemic.”

Fighting Back

Faced with this trio of challenges, the companies interviewed for this story are fighting back on behalf of their narrowbody engine maintenance clients with a series of strategies — with a general focus on the CFM56 family of engines.

At Aero Norway, “our focus is on the CFM56-5B and 7B for some time, which will bring us efficiencies across our company and reduce TAT (turnaround time) due to the commonality across these two platforms,” Russell said. “We do have a CFMI license for LEAP 1A and 1B maintenance, but our plan is to start with light workscopes and build up our capability over time. Our goal is to have one LEAP engine in the shop this year, but we have not shouted about it yet because the demand would distract us from our current strategy.”

StandardAero also sees a benefit in focusing on CFM56s. Specifically, “we are responding to the demand for CFM56-7B MRO by expanding our global MRO capacity for the type, with our ‘traditional’ Winnipeg, MB CFM56-7B MRO location now augmented by additional capability at our DFW International Airport location,” said Thompson. “Originally opened as a hospital shop location last year, this location now offers full engine testing capabilities, with overhaul level services to be added later this year. At the same time, our 810,000 square foot San Antonio, Texas, facility is now also accepting inductions for LEAP-1A and LEAP-1B continued time engine maintenance (CTEM) workscopes, with full PRSV capabilities due to come on line later this year.”

ST Engineering is taking even bigger steps to ease the narrowbody engine maintenance bottleneck. “To meet the rising demand for CFM56 and LEAP engine services, we are doubling our capacity by enlarging the shop floor and office space,” Tay said. “The new engine MRO capacity located within our existing sites will also be complemented by additional warehousing facilities. In gearing up for LEAP MRO demand, we are setting up engine testing capabilities for LEAP-1A and LEAP-1B engines by mid-2024, followed by full performance restoration shop visit capability for both engines by 2025.”

As for coping with the trio of challenges specifically? “To manage supply chain issues, we are working with customers on rotable purchases and with suppliers on used serviceable material supply, as well as strengthening our relationships with key suppliers,” said Tay.

Meanwhile, MTU Maintenance is trying to reduce its reliance on the supply chain by repairing as many engine parts as is reasonably possible. “After all, repair beats replacement, especially in times of long delivery periods and low availability,” Ludwig observed. This is why MTU Maintenance Serbia has a shop solely devoted to repairing high-value parts for CFM56, V2500 and PW1100G-JM engines. In addition, MTU Maintenance Lease Services is teaming up with industry partners to acquire decommissioned aircraft with still serviceable engines in order to boost the network’s stock levels.

Then there’s staffing. “To fortify our talent pipeline, we are actively recruiting technicians with efforts that include collaborations with technical institutes and universities to attract and train students for careers in aviation maintenance,” said Tay. “By investing in robotics and automation, we aim to cut down on routine work by our employees to maximize labor efficiency, while providing them with comprehensive training to ensure that the quality of our MRO work remains high at all times.”

Interestingly, MTU Maintenance is not experiencing a serious staffing shortage. “This is because we were among the very few MRO service providers who did not cut staff during the pandemic,” Ludwig said. “In fact, we actually continued hiring and invested significantly in our locations, because we were always confident that the market would return.” As well, MTU has established learning centers and partnered with academic institutions in Canada, China, and Serbia to give aspiring mechanics all the necessary tools to succeed and exceed at MTU, including opportunities to work across our global network.”

By improving supply chain and staffing issues, these MROs are able to work on reducing lead times for the customers. But Aero Norway has another trick up its sleeve when it comes to improving TAT. “Due to our varied workscopes, we are able to adapt how our production is run to tailor to the different customer needs,” said Russell. “As we are an agile and independent engine MRO facility, our size enables us to offer creative and efficient solutions that benefit our existing customers.”

The Future Looks Bright

Clearly, the narrowbody engine maintenance market is enjoying a happy period of prosperity after the pandemic’s economic pandemonium. Better yet, the prospects for a profitable future look just as promising.

“The narrowbody engine MRO market is poised to continue growing, driven by escalating air travel demand, fleet expansions by low-cost carriers, and the retirement of aging aircraft,” Tay said. ”To meet the evolving needs of this market, we anticipate a surge in the adoption of technologies such as data analytics, automation, additive manufacturing and robotics to drive productivity improvements, and operational resilience.”

“We expect the narrowbody engine market to expand significantly over the coming years,” Akhtar said. “For one thing, many airlines are opting for leasing engines to avoid the substantial upfront costs associated with purchases and heavy restorations, which should increase supply overall. For another, the uptick in demand for used engine parts is having a notable impact on AJW’s engine and MRO business, and as such, the Group is investing heavily in narrowbody aircraft and engines to meet the growing demand.”

This being said, some narrowbody engines have a brighter future in store than others.

“We expect demand for CFM56-5B/7B shop visits to peak in the next year or two, with demand remaining strong from at least the next decade if not longer,” said Thompson. “Meanwhile, demand for CFM LEAP shop visits will quickly grow, thanks to the engine’s tremendous success in the marketplace and the gradual maturation of the in-service fleet.”

MTU’s Ludwig saw value in this assessment. “Legacy engines such as the original variants of the CFM56 (single annular combustor or SAC engines) will start phasing out of the industry at an increasing rate,” he said. “However, shop visit demand for the later Tech Insertion (TI), Performance Improvement Program (PIP) and Evolution (BE) variants will keep shops busy for quite some time. In fact, shop visits for the -5B and -7B should peak in two to three years’ time and remain high until about 2030, while the amount of CFM56 shop visits is expected to return to current levels by about 2033.”

Aero Norway’s Russell is more optimistic about the CFM56’s future as an MRO revenue source. “Engine upgrades on Airbus and Boeing narrowbody aircraft have significantly impacted the industry, extending airframe lifespans,” he explained. “Hence, while CFM56 engines are being replaced by LEAP engines on A320/A319 and 737 models, there remains a substantial MRO market for CFM56 engines. Still, Aero Norway, as an independent engine MRO provider, is strategically transitioning to focus on servicing LEAP engines. We are dedicated to delivering LEAP 1A and 1B services by the end of 2024.”

All told, the story of the narrowbody engine maintenance market is one of growth and good prospects, despite the trio of challenges. This is exactly what MROs, their suppliers, and their airline customers want to hear!