In mid-2023, Aviation Maintenance published an article entitled, ‘PMA Parts Market Booming’. A year has passed since then, leading to this update and this question: Is the PMA (Parts Manufacturer Approval) market — which provides FAA-approved third party parts for Original Equipment Manufacturer (OEM) aircraft made by Airbus, Boeing, and others — still booming today?

Well, according to people in the PMA parts industry, the answer is an unqualified yes!

Owner

Prime Propulsion

“Yes, the PMA market continues to boom with no end in sight,” said James Brooks, owner of Prime Propulsion, an engine and powerplant DER (Designated Engineering Representative) based in Fort Walton Beach, Florida. “The world has continued to embrace PMA and the benefits they bring.”

Chief Engineer,

First Aviation Services

“The PMA market is still flourishing,” agreed Debra Whittaker, chief engineer with First Aviation Services of Westport, Connecticut, which has been in the PMA business since the 1970s and designed hundreds of PMA parts. “We have seen non-stop growth for the last 15 years, but the last three years have been truly excellent.”

Jet Parts Engineering

“The PMA market is still strong and growing as more airlines around the world discover the benefits PMAs bring to their maintenance operations,” said John Benscheidt, president of Jet Parts Engineering in Seattle, Washington, a PMA parts designer and MRO service provider. “As a general data point, Jet Parts Engineering has almost 100 new customers per year that come to us for our parts.”

ACS

“The PMA market is indeed thriving,” concluded Rod Martinez, president of ACS, a supplier of PMA parts. “We’re seeing continued robust growth and a vibrant market environment. The demand for PMA products is stronger than ever, and the trend is expected to continue. We have seen new territories and customers emerge with a clear PMA strategy.”

What’s Driving Industry Growth

In last year’s article, we reported that the lower prices of PMA parts, when compared to their OEM counterparts, was one of many factors driving this industry’s sales boom. According to the experts, this fact remains true today.

Vice President

Heico Parts Group

A case in point: “You reported on some of the supply chain challenges last year. That’s still very much with us,” said Pat Markham, vice president of technical services at Heico Parts Group, a PMA parts manufacturer and MRO located in Hollywood, Florida. “It’s a big driver for new customers coming to the PMA community to provide an approved alternative when an OEM part is unavailable. When customers see how well PMA parts work and it’s an easy way to save money, they tend to look for more opportunities to use more PMA parts.”

“Right now, part availability is a major factor driving PMA purchasing and new part acceptance,” Benscheidt said. “Historically, part cost was the driving factor for PMA, but with the continued supply chain delays from the OEMs, turn times are being negatively affected at the MROs. It’s hard to pass up a PMA part that’s available now — allowing someone to complete an overhaul and bill the airline or get the plane flying again — when the alternative is to wait an additional 60 days for the OEM part to be in stock.”

The fact that OEM parts can be hard to source quickly is motivating ‘reluctant operators’ — aircraft operators who would prefer to use OEM parts if they could get them — to give PMA parts a shot. “A reluctant operator will often use PMAs for the first time when they are in an AOG situation and the OEM is quoting 180, 365, or 500 days,” said Whittaker. “Once this operator discovers that the quality, value and availability of PMA parts are excellent, they don’t go back to the OEM the next time.”

This being said, the lower cost of PMA parts still matters to airlines; especially now when the industry still hasn’t fully recovered from Covid-19. “Airlines have been struggling to balance capacity with demand, which is returning the industry to a world where operational excellence and cost control drive their success against competitors,” said Benscheidt. “With maintenance accounting for 10-15% of airline operating costs, PMA parts are helping airlines directly impact their financial results, not to mention the readiness of their fleet with part availability.”

“The primary factor is cost savings — many airlines are increasingly turning to PMA parts to reduce operating expenses amidst rising OEM prices and labor costs,” Martinez said. But that’s not all: “Airlines are extending the life cycle of their aging fleets, which has generated significant demand for older parts necessary for ongoing maintenance and repairs. So this combination of cost efficiency and the need to support older aircraft has been pivotal in fueling the continued growth of the PMA parts market.”

There’s another factor driving success in the PMA parts industry, and that is better-informed customers. Airlines and MROs now know that PMA parts can match OEM parts on quality and reliability, despite their lower prices and third-party provenance.

“The aviation industry as a whole has become more educated on PMA and replacement parts,” Whittaker observed. “For years, there was a common misconception that PMA parts were generic or of inferior quality to OEM parts. But this isn’t true, because PMA parts must go through a vigorous testing process and obtain FAA approval with respect to their design and quality system. Fortunately, the aviation industry has become more aware of the scrutiny that a PMA part undergoes and is now more accepting of them.”

“Over the last 10 to 12 years, I’ve seen a shift away from the economics of PMA parts as a driving force, to reliability,” agreed Jason Dickstein, president of the Modification and Replacement Parts Association (MARPA). “Today, there are a lot of PMA parts that are being designed to improve upon flaws that have been identified. Typically, the flaws are being identified by operators and they have had problems getting those flaws corrected. So, they’ve reached out to the PMA community and they’ve partnered with the PMA community to design a better part. So, while economics might’ve been the driving force 25 years ago, reliability has been a driving force for at least a decade.”

Even without increased customer trust in PMA parts, sales of these items are being boosted by new aircraft delivery delays. Without the new aircraft they’d counted on in their fleets today, airlines are having to keep flying their older aircraft to maintain their flight schedules.

“Delivery delays are another big driver for the PMA industry, since the airlines are not able to get the number of new aircraft they were expecting,” Markham said. “As a result, they’re having to perform more maintenance on their older aircraft. More maintenance means more PMA parts sales, so it’s a good, positive problem for us.”

The bottom line: The combined factors of OEM supply chain delays, lower PMA parts prices, FAA-certified quality and reliability, better informed customers, and new aircraft delivery delays are keeping the PMA parts boom going and will likely do so for the foreseeable future.

Challenges Still Exist

Even with so many factors coming together to drive the PMA parts markets, challenges still exist for companies in this market.

Ironically, one of these obstacles is the PMA parts industry’s current level of success. “The toughest challenge is unexpected demand,” said Markham. “When there are problems with the OEM delivery/supply chain, that becomes an unforecasted demand for us, which naturally stresses our supply chain. To address this, we continue to try to work with our partner customers to make sure we have the most up-to-date forecast as possible and to try to get as much insight as we can in terms of what their future needs are going to be.”

A second challenge confronting the PMA parts industry is delays in these parts being approved for use by individual airlines, due to their own constrained resources. “These constraints slow the implementation of parts introduced into the airlines’ systems and delay the cost savings they seek,” Benscheidt said. “Similarly, understaffing at the FAA for PMA application reviews and acceptance is a challenge. The FAA is having a hard time keeping their certification offices staffed and producing at levels needed by the industry, so there are many PMA companies stuck in a bottleneck at the end of their development processes.”

As well, leasing firms have tended to restrict the use of PMA parts on their aircraft, in a bid to maintain their assets’ marketability and residual value. However, these restrictions are loosening as fleets age and the anticipated resale market narrows, said Benscheidt. “In fact, some lessors are now finding opportunities to leverage PMA parts to provide lower cost options for their customers who are already using them.”

“Some customers continue to have reservations about adopting PMA parts due to concerns over warranty coverage and compatibility with existing leases,” Martinez agreed. “To address these issues, our industry is working diligently with the FAA to streamline regulatory processes and enhance collaboration with authorities to expedite approvals. We’ve also invested in supply chain improvements and diversifying sources to mitigate disruptions. In the past six months, we’ve seen part availability playing more of an important factor for buyers.”

Finally — like the OEMs — PMA parts manufacturers are facing their own supply chain issues. The good news? According to Dickstein, “Because PMA parts companies tend to be smaller than OEMs, when they have supply chain issues, they simply have the ability to be more nimble. For instance, a large OEM might have to go through a months-long process to bring on a new supplier, whereas a smaller PMA parts company oftentimes can be much quicker in shifting to other suppliers without compromising on quality. They simply have less bureaucracy slowing them down in trying to correct their supply chain issues.”

Where Future Growth Will Come From

For the boom times to continue, the PMA parts industry will have to keep growing in terms of its sales and profits. So where are the growth areas for the PMA parts industry going forward? Is it in newer aircraft, providing more parts for older aircraft, or both?

“Both,” replied Whittaker. “On the one hand, legacy aircraft are troubled with parts obsolescence when the OEM simply quits making spare parts. This means lots of opportunities for the PMA parts industry when the OEM no longer supports a fleet. On the other hand, newer aircraft that are still in production can experience back orders because the OEMs often don’t plan for inventory to support both new and existing fleet. So, if there is a limited supply of a certain part and the OEM needs it for production of new aircraft, they are going to take what they need first before selling spare parts to everyone else.”

“Both new and older aircraft are growth areas,” Benscheidt agreed. “New production aircraft delivery backlogs will keep demand for PMA parts strong, while the durability issues on some of the newer platforms are keeping legacy aircraft flying longer and thus needing parts too. As well, airlines’ fleets of older aircraft aren’t disappearing anytime soon, so as the OEMs shift focus and capacity to the newer generation equipment, it opens further opportunities to grow PMA product acceptance for legacy aircraft. In addition, some of the new generation aircraft have high system commonality with their predecessors (A320ceo and A320neo as an example) so that bolsters the market even further. And eventually, newer generation aircraft will take market share and replace the older aircraft, so there’s a lot of white space for new PMAs on these new platforms as well.”

“It’s going to be both,” said Markham. “Aircraft delivery delays are definitely creating more maintenance for older aircraft, which drives additional PMA growth. In addition, as new aircraft get field exposure, they need to be serviced. This will lead to new PMA parts development.”

As for Innovations That Will Further Drive The Pma Parts Industry’s Future Growth?

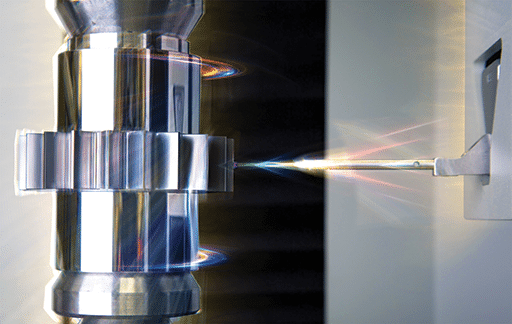

“Artificial intelligence is a hot topic, and it is playing a role in PMA as well,” Benscheidt replied. “We’re not seeing AI in PMA parts design quite yet — the limitations still put it 10+ years away from what some might think of automating development — but AI is serving as an assistant alongside design and certification using generative AI models to search large amounts of data for summaries or using it for more targeted research given specialized parameters.”

AI could also aid the PMA parts industry in handling the pressures of high product demand and supply chain delays. At Heico Parts Group, “we are looking to see if we can leverage AI to better manage some of that unforecasted demand, or get better forecasts, as well as looking more deeply into our supply chain,” said Markham. “At the same time, we definitely live in a ‘trust but verify’ world, so we want to make sure that we understand and can rely on what AI is giving us.”

Over at First Aviation, the company is looking to expand its capabilities, including finding better ways to manufacture PMA parts. To this end, “we are incorporating lean manufacturing principles to expedite the creation and approval of PMAs,” Whittaker said. “We are also keeping a close eye on the market to anticipate when certain fleets are due for overhaul, to ensure that we have the parts and manpower in place to meet our customer’s demand.”

Meanwhile, Jet Parts Engineering is leveraging improvements in 3D scanning technology to help their engineering and quality teams speed up their process, while at the same time gathering and analyzing more data than ever using more traditional tools. “Doing both allows us to ensure our PMA parts are of the highest degree of quality and maintain tighter control of our production without sacrificing additional time or cost,” said Benscheidt.

In general, “the future of the PMA parts industry is set to be shaped by a wave of innovations focused on expanding service offerings and integrating diverse solutions for customers,” Martinez said. “At our company, we’re dedicated to broadening our range of services and parts to meet the evolving needs of the market. Across the industry, we anticipate that successful PMA companies will increasingly invest in diverse business ventures and strategic partnerships. By acquiring businesses that complement their existing capabilities and forming alliances with key players, companies will be able to offer a wider array of services while maintaining competitive costs. These strategic moves will be crucial for keeping pace with OEM offerings and ensuring that PMA parts remain a viable and attractive option for airlines.”

Will the Boom Continue?

Last year, the PMA parts market was booming. This year, the boom continues. So, what about next year: Will the good times continue to roll?

“Absolutely,” Whittaker replied. “The demand for PMA solutions is extremely high and is showing no signs of slowing down. Competition in the aviation industry is relentless and both operators and maintenance organizations are looking for ways to cut costs and to reduce ground time. Buying safe, reliable PMA parts at a discounted price, and with quicker delivery dates, is one way they can stay ahead of their competitors.”

“Yes,” said Brooks. “Airlines continue to request additional parts at an increased rate to support their fleet while reducing costs.”

“Absolutely,” Dickstein said. “Whenever there are problems in the airline industry, the PMA industry has persistently stepped up to be an effective partner for the air carriers and the repair stations. And every time that has happened, the PMA business and its market share has increased. I’ve talked to a number of vice presidents of maintenance at air carriers that have expressed disappointment with the support that they’ve gotten from type certificate and production certificate holders. And in the very next breath, they’ll start to praise the PMA companies that have helped keep the aircraft in the air.”

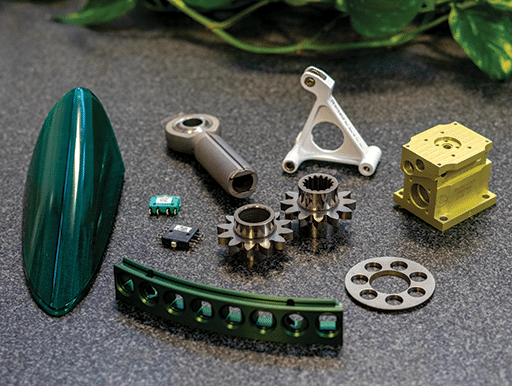

Heico image.

Given all of these considerations, the boom in the PMA parts market seems destined to continue. “Beyond all the reasons why that we’ve talked about so far, airlines want to make sure that they have robust supply chains — and PMA provides an already approved second source of supply,” said Markham. “So, my expectation would be that the PMA parts market will continue to meet those demands and continue to grow in the years ahead.”

“We expect the vended PMA market to grow more than 9% CAGR over the next five years,” Benscheidt predicted. “Moreover, as lessor acceptance of PMA parts relaxes, this will further the adoption of PMA parts and increase the market size. Ultimately, airlines are the driving force behind the PMA parts industry; they seek a competitive market to keep OEMs in check while ensuring availability, safety and reliability. This is why PMA parts will remain a key strategy for airlines to achieve these goals and why the PMA parts market will continue to be strong for many years ahead.”

The bottom line: “The PMA parts market is well-positioned to continue its growth in the years ahead,” concluded Martinez. “The ongoing need for cost-effective maintenance solutions, coupled with safety, advancements in technology and regulatory support, will drive the market forward. As the aviation industry evolves, PMA parts will remain a vital and sustainable component of the maintenance ecosystem.”