According to the Airbus Global Market Forecast 2024, the world freighter fleet in service will reach 3,360 aircraft by 2043, up from 2,220 in 2023, with the 2,240 deliveries split between 1,140 for growth and 1,330 for replacement, and 890 remaining in service. For the growth and replacement category, around 1,530 will be conversions. The deliveries are further split into 970 single-aisle (10-40 tons), 880 mid-size widebody (40-80 tons) and 620 large widebody (>80 tons).

The 2024-2043 Boeing Commercial Market Outlook does not distinguish between new build and converted freighters but says the fleet will grow from 2,340 to 3,900 aircraft to 2043 and will consist of 1,250 narrowbodies (<40 tons), 785 medium widebodies (40-80 tons) and 810 large widebodies (>80 tons).

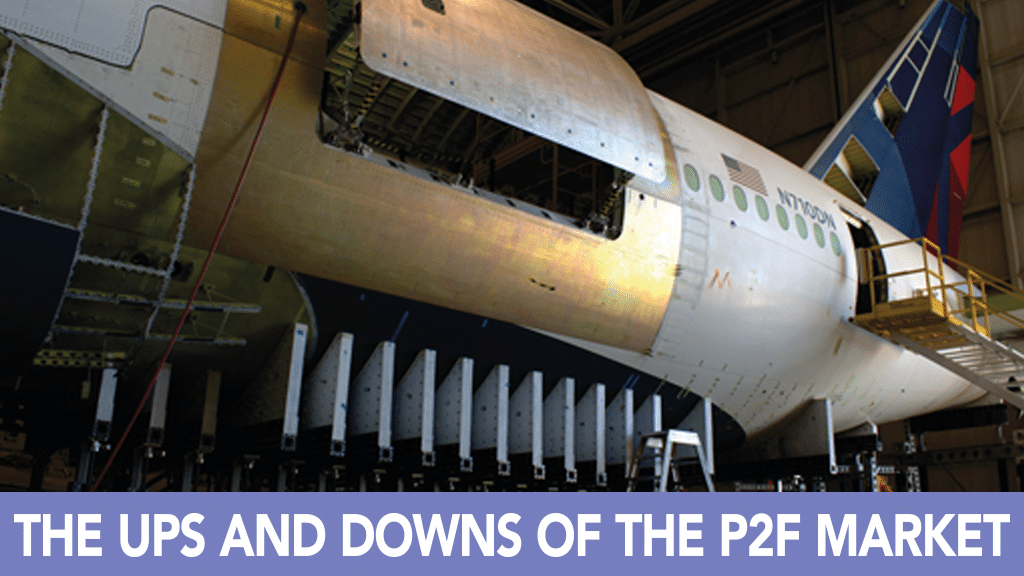

AEI

All very optimistic, with Airbus predicting a 4.6% CAGR over the forecast period but the narrowbody freighter conversion market is a difficult area at the moment, and for the next few years, says Robert Convey, AEI senior vice president of sales and marketing at Aeronautical Engineers, Inc (AEI). The company specializes in the Boeing 737-400/800SF, Bombardier CRJ-200 SF and McDonnell Douglas MD-80SF.

Lower production rates of new aircraft and technical problems with LEAP and GTF engines means that there are very few 737-800 airframes available for conversion, that they have an uneconomically high sale price and there is a huge shortage of CFM56 engines, also inflating prices. In addition, the pandemic demand bubble for freighters has burst. For the next few years, he sees demand as being sporadic, a combination of airlines with cargo operations converting their own passenger fleet or lessors deciding to convert to keep their asset alive for a bit longer.

To illustrate the point, AEI’s forecast for 2023 was for approximately 44 freighters, with the 737-800SF again accounting for most deliveries, plus four 737-400SFs, four CRJ-200 SFs and four MD-80SFs. In reality, it was 28 aircraft – 18 737-800SFs, followed by five 737-400Ss, three CRJ200 SFs and two MD-80SFs.

While the 737-800SF will again represent the majority of deliveries in 2024, he expects the total will be slightly below 2023 figures. The company has stated that it will use this predicted slowdown as an opportunity to complete studies on potentially introducing new AEI freighter programs for the 737-900 and the CRJ 900.

Deliveries this year include a 737-800SF freighter to Democratic Republic of Congo-based Serve Air, with a further five to follow in the coming years, and the twentieth CRJ200 SF freighter to Saltillo, Mexico-based Aeronaves TSM, also the forty-second overall freighter that TSM has ordered directly from AEI.

Elsewhere, Grand China Aviation Maintenance (GCAM), a subsidiary of HNA Aviation Technic, which is the sixth authorized AEI Conversion Center in 2023, has five more 737-800SFs to deliver and KF Aerospace in Canada has been working on three 737-800SF conversions for Air Inuit, two of which are in a Combi configuration.

Given the downturn in demand, the company is being cautious but using the time to study the next potential, with the 737-900 and the CRJ 900ER as two most likely candidates. The -900 will probably be first, with an agreement with Boeing hoped for by year end, which would mean entry into service in the first half of 2027.

EFW

Jordi Boto, CEO of EFW, agrees that the narrowbody market is difficult at the moment — the company has a P2F conversion for the Airbus A320 and A321 developed in collaboration with ST Engineering, with EFW holding the Supplemental Type Certificate.

In particular, airlines are having to keep A321 aircraft in passenger service that were intended to be converted until those delivery and engine problems are resolved, he thinks in 2026/7. A problem for customers replacing Boeing 757s with A321P2F is that they could face the need for an expensive overhaul on an old aircraft. In addition, stricter noise regulations could limit future night operations in Europe. There have been very few cancellations to date but there have been several delays.

One of EFW’s customers is Azul Cargo in Brazil, which received its first aircraft in October, with a second to arrive by the end of the year.

Despite the pressures, EFW signed a MoU with MRO Japan (MJP) to establish an A320P2F/A321P2F conversion line at Naha Airport in Okinawa, where air cargo is forecast to see a huge expansion. Japan’s freighter and logistics market size is estimated to expand at a CAGR of 4.2% between 2024-2029, with air freight being the fastest growing market by mode of transport. The partnership in conversions will make the company Japan’s first conversion site for the new-generation Airbus narrowbody P2F aircraft.

Under the contract, MJP will serve as a subcontractor for EFW, providing third-party conversion services for EFW’s Airbus A320P2F/A321P2F programs. The process of onboarding MJP as EFW’s new modification site involves comprehensive trainings in tooling, engineering, supply chain, industrialization and quality training to ensure operational readiness and excellence. The first aircraft induction for conversion is foreseen to commence by the end of 2025.

“We are excited to have MJP join our global network of P2F conversion sites,” said Boto. “Collaborating with experienced and well-backed aircraft solution providers like MJP supports our capacity for freighter conversions to capture opportunities in the growing Japanese air cargo market.”

Takashi Takahashi, CEO, MJP, added, “We are truly happy that the new partnership between EFW and MRO Japan has been established. It will be a significant step towards mutual growth and prosperity for both parties. Our deepest gratitude goes to EFW for their cooperation and support. We are excited to work with the EFW team to initiate the first modification and move on to the next step.”

The A330 market has a different dynamic, Boto says. This is a new aircraft in the market, offering a much greater capability than the previous workhorse, the Boeing 767, with up to 23% more volume (A330-300P2F), 7% more payload and a 10% wider fuselage catering for 96in containers side-by-side. A seven-inch wider door allows for the transport of 16-foot and 20-foot pallets.

The company has been able to offset the delays to some extent by expanding in different areas. It recently started A380 maintenance again, the first customer being U.K.-based Global Airlines, but it has other customers lined up and will expand activities from 2025 onwards. There is a surge in very heavy and complex 12-year inspections coming up, which is beyond EFW’s capabilities, but it can take advantage of a squeeze on hangar slots to carry out lighter checks. He points out that EFW will be one of few non-airline related MROs working on the type.

Overall, progress has been good, with 18 conversions delivered in 2022, 28 in 2023 and a projected 30-35 in 2024 (the uncertainty reflecting the narrowbody market again).

Mammoth

Brian McCarthy, VP of marketing and sales at Mammoth Freighters, says there is some concern about feedstock as delays to the 777X could extend the in-service life of the 777-200LR and 777-300ER that form the basis of their conversion program. Typically, these aircraft have a service life of around 12-15 years before there is a combination of heavy maintenance checks and a complete cabin and IFE/connectivity refurbishment. As those refurbishments could cost from $8 million to $15 million, he suggests that it does not make economic sense to make that level of investment in aircraft as airlines are only buying 3-6 years of lift until new build Airbus and Boeing production catches up on the backlog.

In addition, each airline has its own distinct branding that runs through the interior, from seats and galleys to color scheme, which makes it is more difficult and expensive to transition them to a new operator. However, he comments, while the 777X delays have meant that airlines like Emirates, with a huge 777 fleet, have had to make those investments to maintain their standards, those with smaller fleets cannot justify the expense.

Incidentally, Emirates Sky Cargo ordered a further five Boeing 777Fs on order, having previously ordered five, while also has 10 777-300ERs currently being converted into freighters by IAI BEDEK. That program should have been certified by now but appears, for very obvious reasons, to have encountered some delays.

He says determined cargo operators will locate and purchase aircraft where they can, with engines and spares support from the relatively few part-outs that are occurring, but he warns that, if freighter demand is strong enough, those part-outs will decline and could constrict surplus parts availability.

However, Mammoth already has commitments for 29 -200LRMFs and six -300ERMFs with airframes already designated and with planned start dates for the conversions. These will take place at Aspire MRO in Fort Worth and at STS Aviation in Manchester, U.K.

Identified customers are launch customer Jetran, which took Cargojet Canada’s four -200LRMFs early positions in the Mammoth program. Jetran has additional orders for 777-200LRMFs, while AviaAM Leasing has the six -300ERMFs and DHL has eleven -200LRMFs coming from Mammoth via Jetran. Some of Mammoths customer commitments are undisclosed at this time.

The first -300ERMF is in work at Aspire and the first two -200LRMFs at STS, with the second -300ERMF to be in work at Manchester no later than January 1, 2025. He points out that having multiple aircraft under conversion simultaneously is more efficient as labor can be moved to the area of highest activity. The first 777-200LRMF cargo loading system was delivered by Collins Aerospace in July, while the door cut on the first -300ERMF was completed at Aspire a month later.

McCarthy says having such a backlog buys Mammoth some time to get new orders as it proceeds towards certification. One source of those orders might be airlines who are flying production 777F alongside passenger aircraft, which gives them a degree of flexibility in having their own feedstock.

Another reason that makes this a possibility is that next-generation freighters will be later than planned. It takes some time to deliver the bow wave of initial orders before the production rate settles down to allow the introduction of new build freighters to the line, so the 777X freighter is some way off. He suggests that Airbus may be able to take off some of the pressure through A350 passenger aircraft deliveries, allowing 777 retirements for conversion — the Mammoth advantage is nearly the same amount of cargo for $100 million less.

The potential total market is 200-250 aircraft in the forthcoming years, split between Mammoth, IAI BEDEK and the third 777conversion project by Kansas Modification Center (KMC) and WERX, part of Wichita State University’s National Institute for Aviation Research.

His experience shows that once a program is out there flying, there is a tendency for one to become the standard, as happened with the Boeing 757 during his time at Precision Aircraft Solutions, based on payload/range, quality and reliability. There is room for two, but not three, 777 conversion providers, says McCarthy.

Another consideration is that the bow wave effect will also be seen here, so there is a need to be ready for 18-20 aircraft per year. Mammoth already has the capacity to build 24 cargo doors per year. There are five conversion lines in Fort Worth and two in Manchester, each capable of around three aircraft per year, so 21 aircraft in total.

The next step is certification, with the master STC for the -200LRMF and an amended STC for the -300ERMF. The first aircraft, a -200LRMF, should be ready for company flights in late December/early January. Formal FAA light tests will follow in the first quarter which should yield FAA Type Inspection Authorization (TIA) within that quarter. The hope is certification in March, with the -300ERMF following in August. No certification work will be done in the U.K., however, as the company is planning both EASA and CAA validation of FAA STCs.

The first -300ERMF is in work at Aspire, along with four -200LRs awaiting conversion. These will be followed by the first two -200LRMFs at STS, with the first in work and the second arriving in early November.

Depending on the market, a further conversion line might be established in the Asia Pacific region, where, he says, customers typically have a lot to say about where they would like to see aircraft converted. If the business presents itself in the years ahead, Mammoth will not hesitate to establish a presence there.