With OEM supply chains strained, airlines and MROs are embracing FAA-approved PMA parts for cost, speed, and reliability — and the market is growing fast.

In 2023 and 2024, Aviation Maintenance’s annual report on PMA (Parts Manufacturer Approval) sales reported solid growth. This brings us to 2025: Is the PMA production industry — which provides FAA-approved third-party parts for Original Equipment Manufacturer (OEM) aircraft made by Airbus, Boeing, and others — still doing well? The answer is an unequivocal “Yes!”

Market Health

“The PMA market remains strong and continues to grow,” said John Benscheidt, president of Jet Parts Engineering. “Airlines globally recognize the value PMA brings in not just in cost savings, but in strengthening the supply chain with part availability. Over the past year, we’ve seen steady expansion from long-time PMA users and adoption from first-time customers who are turning to PMA out of necessity due to the challenges they’re having with the OEMs.”

“We continue to see tailwinds in this market as more and more operators and MROs adopt PMA to shorten lead times, improve supply chain parts availability metrics, and reduce costs,” said Dennis Santare, Aviation Technical Services’ (ATS) senior vice president of component & engineering solutions. “This market is specifically driven by adoption and approvals — more of that will drive more consumption, along with the usual drivers like aircraft utilization and age, which are also favorable fundamentals for the market right now.”

More Than Just Price

Historically, airlines and other aircraft operators have purchased FAA-approved PMA parts because they offer the same quality as OEM parts, but usually at a lower price. This remains a factor in PMA sales today. “However, post-Covid, FAA-PMA parts development and usage has increased due to supply chain challenges for airlines, MROs and even OEMs looking for part availability solutions,” said Patrick Markham, vice president of HEICO Parts Group Technical Services. “Market conditions have increased demand for providing PMA solutions to our customers.”

How serious is the shortage of OEM parts? “Parts availability has been a key issue over the past three years,” replied Paul Bolton, president/COO of First Aviation Services. “As a result, we have seen customers who were historically OEM-centric change their perspective and open up to alternative solutions.” Rod Martinez, president of Aviation Component Solutions (ACS), added that “supply chain constraints continue to challenge the industry, but they’ve also created opportunities for companies like ours that can respond quickly and effectively.”

The bottom line: “Established PMA companies are aggressively developing new parts to help airlines and MROs strengthen the supply chain — particularly where OEMs cannot meet demand,” said Stewart Pope, owner of Fulcrum360. “Airlines that historically avoided PMA adoption are now being forced by supply chain shortages to explore it, often finding great success. So, while cost savings remain the primary reason for airlines to approve PMA use, parts availability is currently the biggest driver.”

Key Trends: Availability, Technology, Materials, OEM Partnerships

Based on what the experts tell us, the “need for parts now!” is the dominant trend in the PMA market today. “Part availability is still the biggest driver of PMA adoption,” Benscheidt said. “While cost is always important, MROs and operators are increasingly prioritizing who can deliver a quality part now.”

Rod Martinez agrees with Benscheidt’s assessment, but takes a bigger picture view. “The primary trend driving PMA parts adoption remains specific customer needs,” he explained. Yes, availability counts, but so does “the demand for faster lead times, consistent quality and competitive value.”

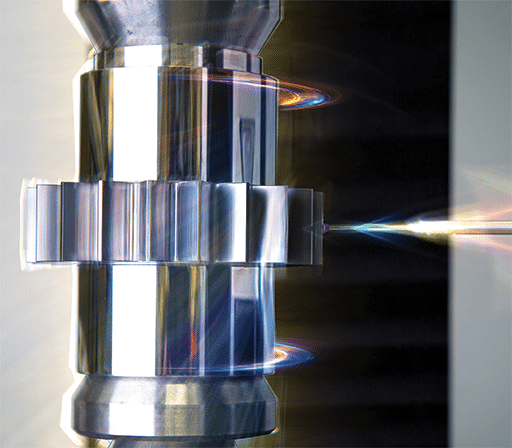

Meeting customer needs is the top trend at HEICO Parts Group Technical Services. In their case, “PMA development is mainly driven by our customers’ needs for fleet maintenance,” Markham said. “Our use of newer technologies, such as 3D printing, is lagging somewhat behind the OEMs, as we are providing solutions for parts that were designed and developed with older technology and manufacturing processes. Nevertheless, we continually investigate ways to adopt new technologies in design and development to improve our manufacturing lead times and reduce costs.”

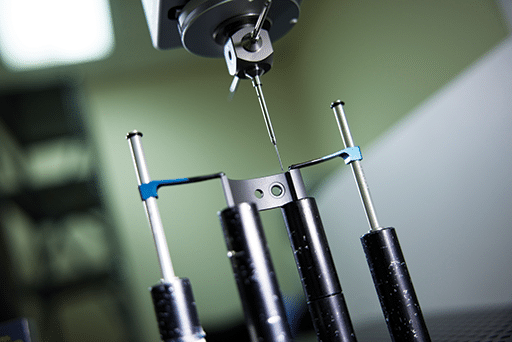

Aviation Technical Services is certainly interested in the new technology trend, even if modern digital equipment is being employed to make legacy parts. “This is why our ATS engineering team recently invested in an Artec Leo wireless and AI-driven 3D scanners to enhance the processes surrounding both PMA development and our repair engineering offerings,” said Santare. “Using these scanners allows our engineers to travel to the customer’s facility and scan parts in real time that they are having issues with, in terms of affordability, reliability, and/or availability. Our engineering team also utilizes 3D FDM printing to validate our test and computation designs. We compare the 3D printed models of our PMA design to the OEM parts to ensure all details and dimensions are comparable.”

Materials research and application is a further trend driving the PMA industry. “I’m seeing a lot of older OEM parts that have corrosion issues being materially reengineered by PMA manufacturers,” noted Jason Dickstein, president of the Modification and Replacement Parts Association (MARPA). “Where it makes sense, PMA companies are developing new materials for these parts, even though these replacements obviously require test and computation approval by the FAA. That’s why these PMA companies are bringing in material science engineers to support those test and computation approval applications.”

Dickstein is seeing yet another trend in the PMA market, namely “cooperation between the OEM type certificate holders and PMA companies in the development of new PMAs,” he said. “It’s quietly always happened in the past, but now this OEM/PMA cooperation is becoming a little bit more public. Today, even engine OEMs are buying PMA parts to relieve their supply chain issues.”

The Tariff Factor

Given that the United States is charging tariffs on imported OEM parts, one would think that these charges are a boon for U.S. PMA manufacturers. And one would be right — and wrong as well.

On the “right” side of the equation, “tariffs on certain imported OEM parts have given U.S.-based PMA providers a relative pricing advantage in the domestic market,” said Benscheidt. “That said, PMA growth is still primarily driven by performance, reliability, cost, and lead-time advantages; tariffs are just an additional nudge for U.S. customers.”

“Imported Airbus OEM parts are getting hit with tariffs,” Dickstein told Aviation Maintenance magazine. “But even before tariffs, OEM Airbus parts were already more expensive than PMAs. So, for domestic U.S. purchasers, the tariffs just make these OEM parts even more expensive.”

On the “wrong” side of the equation, tariffs are affecting PMA providers who have a foot in the U.S. MRO sector. “First Aviation’s Piedmont Propulsion Systems propeller MRO facility has been most affected by tariffs as it services both GE Dowty (U.K.) and Collins-Ratier Figeac (France) propeller components,” Bolton said. “But as we also offer USA-produced alternative parts, we have been able to realize cost savings.”

“Like every industry, the situation with tariffs has been very dynamic and we are working through it,” said Markham. “Fortunately for HEICO, a majority of our suppliers are U.S.-based; however, a small percentage of the raw materials and components used in the manufacturing of our parts may be affected by tariffs. Equally fortunately, our sales have been robust throughout the market both domestically and internationally, and maintaining a price advantage over OEMs has always been a key factor in PMA growth.”

As for ATS? The company has not experienced any tariff impacts related to its PMA business. “This is because the majority of our current customers are U.S. airlines and most of our supply chain sits inside of the U.S. as well,” Santare said. “However, we are increasing the number of exports we do as foreign carriers adopt more and more PMA parts, so tariffs in other countries will become an inevitable challenge for us.”

Finally, tariffs have had a general impact on sales in the aviation maintenance space, and not necessarily for the better. “The most notable impact has been a shift in buying behavior — driven less by the direct cost of tariffs and more by the uncertainty they create,” said Martinez. “We believe the aerospace industry is resilient and global enough that the long-term impact of tariffs will remain limited. That said, we are continuing to monitor the situation closely and are always ready to support customers who need stable, cost-effective alternatives.”

Poised for Growth

Tariffs notwithstanding, the global PMA market seems poised for continued growth. This is because the combination of PMA parts’ lower prices and better availability make them irresistible to a growing number of aviation customers.

“ATS has continued to invest in its PMA business since its 2015 inception and has seen growth from all the U.S. airline majors,” said Santare. “We have also seen consistent growth internationally with PMA approvals from airlines in Asia, Europe, the U.K., and Latin America. As well, we see a lot of growth coming from non-critical parts that are under-supported by others in the supply chain. For example, brackets, wear surfaces, hinges, and other hardware receive very little attention, yet those parts could keep an aircraft waiting in the same way it might wait for an engine or landing gear. We also see a lot of demand for doors and panels that are difficult to obtain from other sources.”

“ACS continues to see strong growth potential in North and South America, as well as in China, where demand for alternative solutions is rising in response to both cost and supply chain challenges,” Martinez said. “From our vantage point, the PMA market is evolving and growing — not shrinking. Many regions/customers are at the beginning of the PMA adoption cycle, motivated by the great examples of PMA parts usage by the large U.S./EU carriers and MROs.”

As for where the PMA parts makers will be selling to? “I believe we’ll see continued growth in legacy fleets and their critical parts, as OEMs move forward to next-generation support,” replied Bolton. “As well, since the deliveries of new aircraft have slowed, older aircraft have to fly longer — and that’s good news for us.”

“In the normal evolution of airline fleets, the PMA market tends to focus on the mid-life to mature aircraft,” Markham agreed. “However, new aircraft delivery delays have forced airlines to keep older fleets in service longer. These delays have given some of the mid-life fleets an extra maintenance cycle. These extra cycles are creating an overlap of the current fleet with the newer aircraft, allowing the PMA community a smoother transition into the newer fleets.”

John Benscheidt is optimistic about PMA sales opportunities on both sides of the airlines’ fleets. “Growth potential exists in both older and newer aircraft platforms,” he declared. “OEM production backlogs are extending the operational life of older fleets, and durability issues on some newer platforms are accelerating PMA opportunities there as well. Commonality between generations (such as A320ceo and A320neo) extends the market window even further.

Contraction will likely occur where aircraft are being retired in large numbers with limited interchangeability, but most of these larger fleet shifts already occurred during Covid. Overall, we expect growth to outpace any losses.”

The Future Looks Promising

Taken as a whole, the market forces that are boosting the PMA industry today seem likely to keep bolstering its fortunes into the future.

Beyond factors such as price and availability, the industry’s improved customer research has made a positive difference. “There was a point in time when PMA companies would design a part and then go out and find customers for it,” mused Dickstein. “That still happens, but the PMA business model has since shifted to asking customers about which parts they want to see developed, and then doing it.”

This approach is certainly endorsed by HEICO. “By working closely with our diverse customer base, new product lines are being identified based upon their fleet-specific wants and needs,” Markham said. “This has been a decades-long, proven process of developing new parts and expanding our product portfolio.”

PMA manufacturers truly work together to provide alternative solutions to customers’ problems. To achieve this goal, “we come together multiple times a year through conferences hosted by MARPA to discuss idea generation and process change to give customers options when the OEM solution is not available to them due to availability, cost, and lead time,” said Santare. “We see an opportunity for PMA providers to collaborate on bringing a wider array of technologies to market for the airlines, rather than just operating inside individual ‘sweet spots’.”

As well, ATS has enhanced its internal IDEA program that encourages ATS team members (“mainly our wonderful mechanics and technicians”) to suggest parts for PMA manufacture to our engineering team. “If the part is approved by the FAA, the employee receives a bonus check from our company,” Santare said. “Next year, we are rolling out a program enhancement where employees would get an additional bonus if the part becomes an important part of the supply chain for our customers.”

Over at ACS, “we’re focused on building upon our current product catalog by expanding into part numbers that align with current fleet mix, ATA chapters and Next Higher Assemblies already in our portfolio,” said Martinez. “We’re also continuing to strengthen our customer relationships. Being the first to understand their stock requirements, upcoming contracts and day-to-day problems gives us a competitive edge in an increasingly complex environment. Finally, as supply chain disruptions persist, we’ve found that parts availability drives the customer’s buying decision-making. We’re leaning into this need by optimizing our inventory planning and expanding our eCommerce capabilities to get parts into customers’ hands faster.”

Clearly, PMA parts are becoming more and more common in OEM aircraft. So just how far can this trend go? “While it is unlikely that an entire aircraft will be built using 100% PMA parts, HEICO parts are used in almost every ATA chapter,” Markham said. “There are many LRUs where every or almost every replaceable part has a HEICO PMA approved label on it.”

“ATS believes that there are areas of the aircraft where, like automobiles, you could theoretically see 30-50% penetration by PMA,” said Santare. “There are also areas of the aircraft that are not likely PMA targets within the life cycle of that aircraft type. Many parts of a typical aircraft either remain available for long portions of the life cycle, generate little demand, or are so low cost that PMA does not make sense.

“As for an all-PMA aircraft? It’s unlikely from a regulatory and economic sense,” concluded Benscheidt. “PMA works best as a complementary strategy, targeting parts where we can deliver clear advantages in cost, lead time, and performance. That’s where the industry will continue to be focused.”